Risk Researcher - Needs Analysis

The needs analysis can be used to calculate the level of insurance required for a client. This can be done by selecting the Needs Analysis tab under Current Situation and change the drop down box next to Would you like to use the Needs Analysis XTOOL? to Yes:

The Needs Analysis defaults to being for the Client Needs and can be changed to the Partner Needs on the toolbar to the left of the page as per the below image:

If the Partner Needs tab does not appear on the left menu, it could a result of one of the following:

- The Marital Status in Key Details > General is not set to Married

- A separate XTOOLS scenario has been created where the Marital Status is set to

Import Wizard

By using the Import Wizard function you are able to automatically pre fill a majority of the Data required for the Needs Analysis, provided you have done a Fact Find for the client and has already been inputted in Client Focus:

If you are going to use this function, it’s recommended to Import the data first before making any amendments as the Import will override anything you have already entered.

Import All: Will import all the available information into the calculator

Proceed: This will give you the option to import specific information by unticking any of the below:

Once you have made your selections, click on Next and there will be a message “Ready to process - proceed?” as final confirmation, then you will need to click on Proceed to complete the import.

If you are going to use the Import Wizard, the Employment Details will not import as they are custom fields in Xplan.

Calculation Mode

Definitions referring to the below image:

Present Value - the present value of each cash flow item is then calculated using a growing annuity formula based on the actual funding period.

Salary Multiple - Using the salary multiple method takes the client's current salary and multiplies it. For example, $50,000 per year multiplied by 5 gives a calculated coverage of $250,000.

Capital Preservation - allows you to determine a sum insured that is large enough to fund future expenses (from income generated) without depleting capital.

Analysis Mode

Simple - enables simple entry for each needs analysis item with no projections

Detailed - allows entries with projections

Splits - provides a combination of both with a separate calculation of upfront and ongoing needs

Assumptions

By clicking the Assumptions link you can select which insurances you would like to include in the needs analysis and whether to use continuing income to offset liabilities in the Upfront Liabilities option

Inputting Values

In this section you can record the figures against each applicable type of expense for Life, TPD and Trauma. For each requirement you can automatically copy the same amount of cover into all three types of cover by first clicking inside a box to enter the amount of cover, then selecting the Fill link that appears:

Once you select Fill a pop up will appear to enter in the value of the specified cover:

If the value of cover is going to be the same across each of the fields, you can Overwrite those fields by selecting the number in the drop down as per the below image, the number you select will be inclusive of the selected field:

The sum of all values entered for each insurance type will calculate in the Total Capital Required row.

Figures for annual Income Protection and Business Expenses can be entered directly into Total Capital Required.

Capital Provisions are assets which can be sold or income that will continue following an insurable event. Adding in figures in this section will decrease the total insurance required.

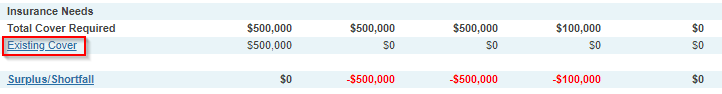

Insurance Needs

The formula for calculating the total insurance required is:

(Total Capital Required) – (Total Capital Available) = Total Cover Required

If the client holds any existing insurance click the underlined Existing Cover and enter in the insured amounts against each relevant insurance type:

The formula for how Surplus/Shortfall is calculated is:

(Total Cover Required) – (Existing Cover) = Surplus/Shortfall

To return to your scenario click the Back to Details button at the top right of the page.